Now that 2015 has come to a close – and we’re finally getting used to writing 2016 on our dates – many families will begin to prepare their finances for tax season. As you do so, don’t forget to look into the Federal Adoption Tax Credit.

Now that 2015 has come to a close – and we’re finally getting used to writing 2016 on our dates – many families will begin to prepare their finances for tax season. As you do so, don’t forget to look into the Federal Adoption Tax Credit.

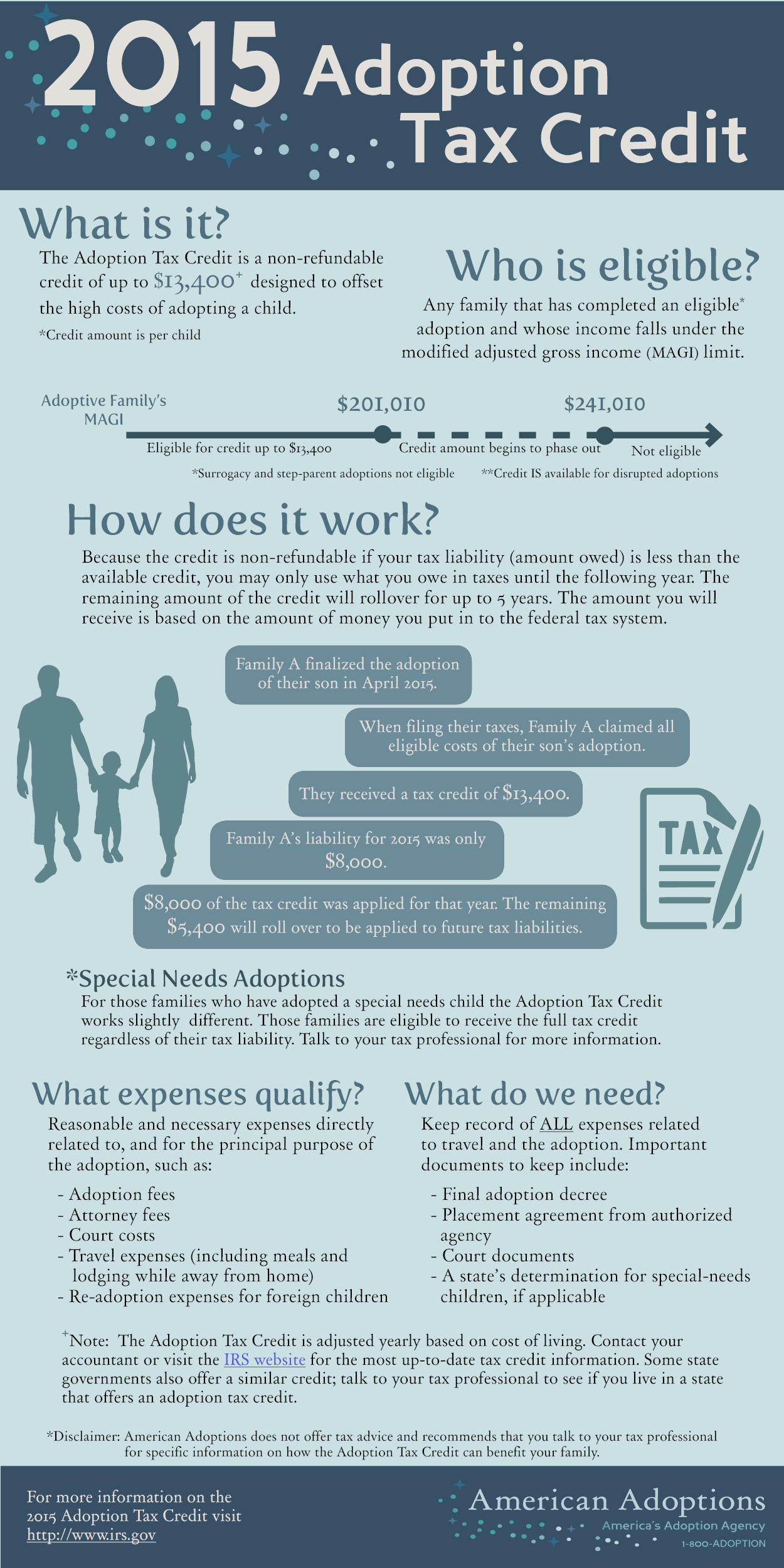

For 2015, the maximum adoption tax credit is $13,400 for all qualifying adoption expenses. The adoption tax credit is not refundable, which means that only those individuals with tax liability (taxes owed) will benefit. The credit will remain flat for special needs adoptions (those involving children who are deemed hard to place by a child welfare agency), allowing those families to claim the maximum credit regardless of expenses.

The adoption tax credit income limit is based on modified adjusted gross income (MAGI) and is recalculated each year. In January 2013, the Federal Adoption Tax Credit was made permanent, although the credit could change or be eliminated in the event of future tax code reform. See the infographic at the bottom of this post for more information on how the tax credit can help your family.

If your family also lives in a state that offers an adoption tax credit (amounts vary by state), you may receive credit for additional expenses as well.

Read more about the Adoption Tax Credit, qualifying expenses and how employer reimbursements could affect your tax credit status on our website. And follow the American Adoptions’ blog for any new updates on the adoption tax credit.

Haven’t Yet Finalized Your Adoption Placement?

Learn How to Seek the Adoption Tax Credit Before Finalization

Every year, adoptive families ask if they can file taxes without their child’s social security number, which is typically received after the adoption is finalized.

Your adoption attorney should apply for a SSN along with the final amended birth certificate after the finalization court hearing. If you do not have these items yet, you our your accountant and/or tax representative can apply for a temporary tax identification number for the baby. You can file your taxes with that number. Here is a link to Form W-7A for information aboutobtaining a temporary tax ID number. You can also search the IRS website for Adoption Taxpayer Identification Number information.

For more information on the adoption tax credit and exclusion, visit www.irs.gov. American Adoptions recommends that you contact a local accountant or qualified tax professional for more specific information for your family.

The Federal Adoption Tax Credit needs your help!

Currently the Federal Adoption Tax Credit is nonrefundable, so it can only help certain families. Because of this, the Save the Adoption Tax Credit Working Group is currently working with members of Congress in an effort to preserve the tax credit and make it a refundable credit. As a refundable credit, every adoptive family within the MAGI range would benefit, making adoption a more affordable option for our families. Learn more about how you can help advocate for a refundable credit.